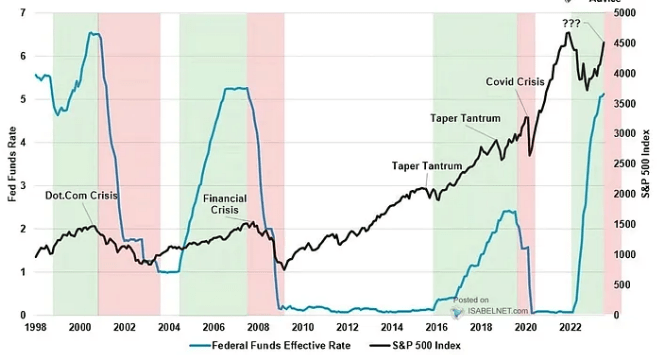

Federal Reserve interest rate cuts can significantly impact the stock market, creating opportunities for investors. By understanding which sectors and stocks typically benefit from these cuts, you can better position yourself to make informed investment decisions. In this post, we’ll explore the top sectors that thrive in a low-interest-rate environment and highlight some promising stocks to consider.

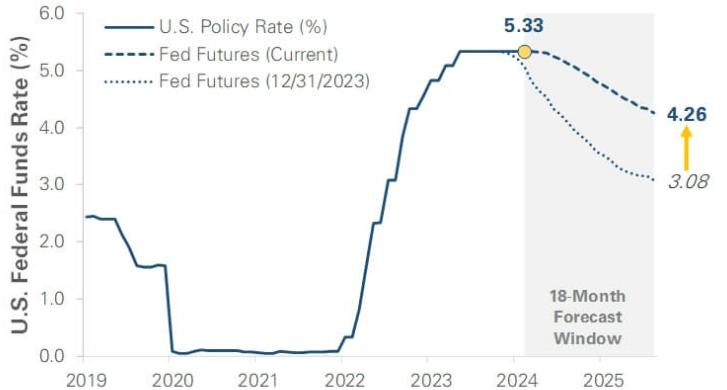

Understanding Federal Rate Cuts

A Federal Reserve rate cut is a monetary policy tool designed to stimulate economic growth. By lowering borrowing costs, the Fed encourages businesses to invest more and consumers to spend. This increased economic activity often leads to a rise in stock prices, particularly in certain sectors.

Top Sectors That Benefit from Federal Rate Cuts

Technology

Tech companies often rely on significant capital investment for research, development, and expansion. Lower interest rates reduce borrowing costs, allowing these firms to accelerate growth initiatives.

Stocks to Watch: Apple (AAPL), Microsoft (MSFT), Alphabet (GOOGL)

Consumer Discretionary

Reduced borrowing costs make it more affordable for consumers to buy non-essential goods and services. As a result, companies in the consumer discretionary sector typically see a demand boost.

Stocks to Watch: Amazon (AMZN), Tesla (TSLA), Nike (NKE)

Real Estate (REITs)

Lower mortgage rates due to rate cuts often lead to increased demand for real estate. This benefits Real Estate Investment Trusts (REITs), which profit from property investment.

Stocks to Watch: Simon Property Group (SPG), Prologis (PLD)

Utilities

Utilities carry significant debt for their capital-intensive operations. Lower interest rates reduce borrowing costs, improving their profitability. Additionally, their stable dividend payments make them attractive when bond yields decline.

Stocks to Watch: NextEra Energy (NEE), Duke Energy (DUK)

Homebuilders & Construction

As mortgage rates decrease, demand for housing grows, benefiting homebuilders and construction companies. Rate cuts create a favorable environment for these sectors to thrive.

Stocks to Watch: Lennar (LEN), D.R. Horton (DHI)

Dividend-Paying Stocks

When bond yields drop, investors often seek dividend-paying stocks for more reliable income. Companies in sectors like consumer staples and utilities with consistent dividends become more attractive.

Stocks to Watch: Johnson & Johnson (JNJ), PepsiCo (PEP), Coca-Cola (KO)

Why These Sectors Thrive During Rate Cuts

- Reduced Borrowing Costs: Lower interest rates make it cheaper for companies to borrow funds, enabling them to invest in growth and expansion.

- Increased Consumer Spending: When interest rates are low, consumers are more likely to make large purchases, benefiting consumer-driven sectors.

- Stable Income: Dividend-paying stocks provide a reliable income stream, especially when bond yields are low.

- Real Estate Demand: Lower mortgage rates boost demand for housing, benefiting homebuilders and REITs.

By focusing on the sectors that thrive during Federal Reserve interest rate cuts, investors can potentially capitalize on the opportunities presented by a low-interest-rate environment. Consider the stocks within the technology, consumer discretionary, real estate, utilities, homebuilding, and dividend-paying sectors as you shape your investment strategy.

Disclaimer: As always, remember to perform thorough research and take your risk tolerance into account before making any investment decisions.